Contribution Margin Ratio: Definition, Formula, and Example

For example, if the cost of raw materials for your business suddenly becomes pricey, then your input price will vary, and this modified input price will count as a variable cost. The contribution margin shows how much additional revenue is generated by making each additional unit of a product after the company has reached the breakeven point. In other words, it measures how much money each additional sale « contributes » to the company’s total profits. Alternatively, companies that rely on shipping and delivery companies that use driverless technology may be faced with an increase in transportation or shipping costs (variable costs).

Which of these is most important for your financial advisor to have?

This cost of the machine represents a fixed cost (and not a variable cost) as its charges do not increase based on the units produced. Such fixed costs are not considered in the contribution margin calculations. Gross margin is calculated before you deduct operating expenses shown in the income statement to reach operating income. Each profit measure can be expressed as total dollars or as a ratio that is a percentage of the total amount of revenue.

AccountingTools

If the annual volume of Product A is 200,000 units, Product A sales revenue is $1,600,000. When the contribution margin is calculated on a per unit basis, it is referred to as the 20 best restaurant accounting software of 2021 or unit contribution margin. You can find the contribution margin per unit using the equation shown below. For example, assume that the students are going to lease vans from their university’s motor pool to drive to their conference.

To Ensure One Vote Per Person, Please Include the Following Info

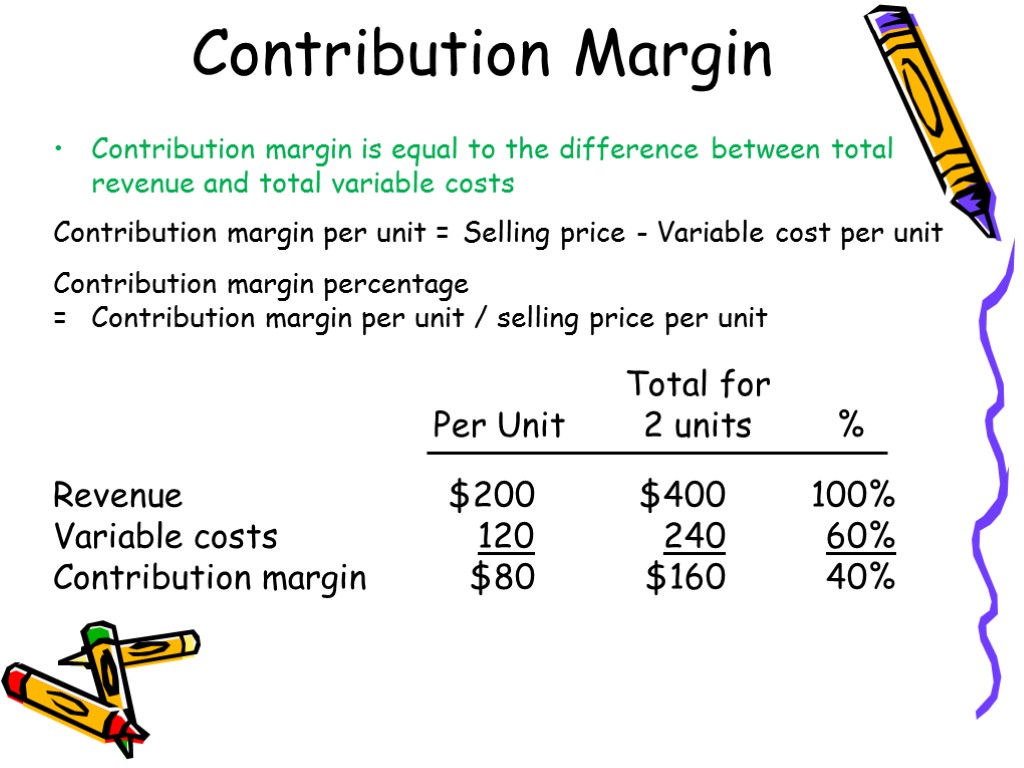

This \(\$5\) contribution margin is assumed to first cover fixed costs first and then realized as profit. Businesses calculate their contribution margin as a total contribution margin or per-unit amount for products. You can show the contribution margin ratio as CM relative to sales revenue. And you can also compute the variable expense ratio, which is the percentage of variable expenses divided by sales. It appears that Beta would do well by emphasizing Line C in its product mix. Moreover, the statement indicates that perhaps prices for line A and line B products are too low.

Is contribution margin the same as profit?

Variable costs are not typically reported on general purpose financial statements as a separate category. Thus, you will need to scan the income statement for variable costs and tally the list. Some companies do issue contribution margin income statements that split variable and fixed costs, but this isn’t common.

Use of Contribution Formula

This information is useful for determining the minimum possible price at which to sell a product. In essence, never go below a contribution per unit of zero; you would otherwise lose money with every sale. The only conceivable reason for selling at a price that generates a negative contribution margin is to deny a sale to a competitor. The Contribution Margin is the incremental profit earned on each unit of product sold, calculated by subtracting direct variable costs from revenue. Variable expenses directly depend upon the quantity of products produced by your company.

- A business can increase its Contribution Margin Ratio by reducing the cost of goods sold, increasing the selling price of products, or finding ways to reduce fixed costs.

- These core financial ratios include accounts receivable turnover ratio, debts to assets ratio, gross margin ratio, etc.

- After all fixed costs have been covered, this provides an operating profit.

- Gross margin is shown on the income statement as revenues minus cost of goods sold (COGS), which includes both variable and allocated fixed overhead costs.

Overall, per unit contribution margin provides valuable information when used with other parameters in making major business decisions. It provides one way to show the profit potential of a particular product offered by a company and shows the portion of sales that helps to cover the company’s fixed costs. Any remaining revenue left after covering fixed costs is the profit generated. However, the growing trend in many segments of the economy is to convert labor-intensive enterprises (primarily variable costs) to operations heavily dependent on equipment or technology (primarily fixed costs). For example, in retail, many functions that were previously performed by people are now performed by machines or software, such as the self-checkout counters in stores such as Walmart, Costco, and Lowe’s.

The concept of contribution margin is applicable at various levels of manufacturing, business segments, and products. Where C is the contribution margin, R is the total revenue, and V represents variable costs. In May, \(750\) of the Blue Jay models were sold as shown on the contribution margin income statement.